scroll text to advance content . click image to toggle zoom & drag to pan

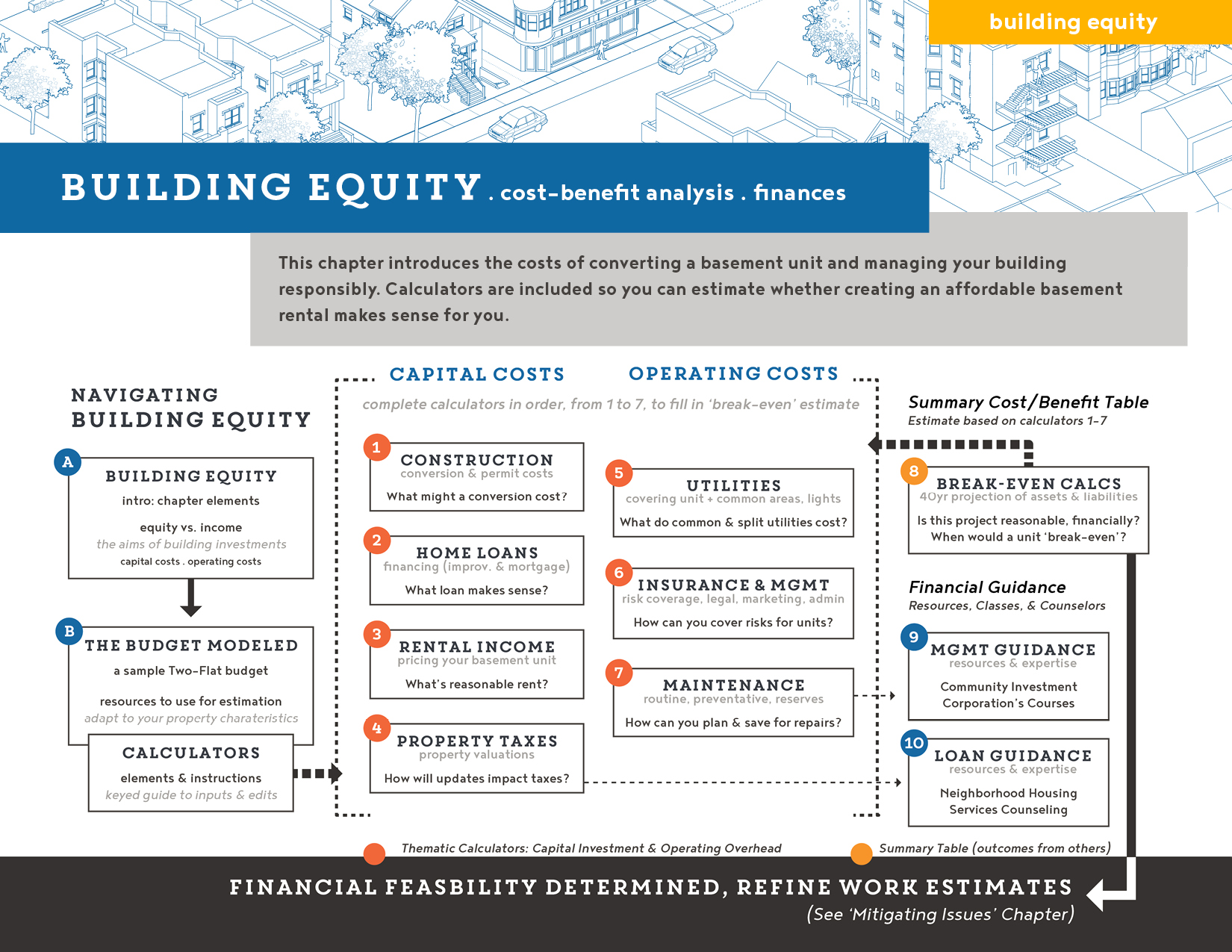

Building Equity introduces the costs of converting a basement unit and managing your building responsibly. Calculators are included so you can estimate whether creating an affordable basement rental makes sense for you.

Building Equity

Chapter Contents

This ‘Building Equity’ chapter introduces the larger costs of converting a basement unit and operating as a responsible landlord.The following pages outline common project prices (capital investments) as well as the oft overlooked costs of management and maintenance (operating costs). As these sums are ultimately interwoven, this chapter provides both thematic overviews and rough calculations in a series of linked spreadsheets.

- Each thematic page outlines the core elements to consider and the variables that impact capital or operating costs (#1-8 at right). The icon, left, highlights additional resources to refine your estimate, and expert guidance - whose official reports, quotes, and numbers supersede these initial calculations.

- The sequential calculators offer a rough, early estimate of: a) whether you can afford to finance a basement conversion and b) when your property investment will ‘break-even.’ By inserting your initial property and project information, you can trace the elements and issues reflected in the annual cost-benefit analysis(#8). Instructions on editing and inserting values begin on page 99, with specific entries elaborated in tandem with the thematic discussion (#1-8). A locked, sample version of the calculations, with values for a Two-Flat conversion, is available here for reference.

- The linked calculators should be done in order, from Construction (#1) to Maintenance (#7). Values estimated in earlier sheets feed into later estimates.

- The linked calculators are not meant to replace expert guidance; they are meant for rough estimations. If you lack an architect, contractor, and their official estimates, the calculators can help you understand whether it makes financial sense to begin planning a basement conversion (and thus hire professionals above).

core themes & tables:

capital investments:

This financial introduction begins with the ‘up-front’ and capital costs of basement conversion, with concepts and calculators for:

- 1 construction & permits, as shaping,

- 2 home improvement loan terms,

- 3 rental income, and

- 4 your tax assessment & building appreciation.

As a homeowner, you are probably familiar with these big-ticket items. We begin with them because, even without the operational costs of building management, it may not make financial sense to pursue a large construction project based on your existing debts or surrounding rates of neighborhood appreciation.

Operating costs:

The second half of this chapter focuses on the operational costs of managing a building, including:

- 5 utility bills

- 6 insurance and administrative fees, and

- 7 maintenance and savings reserves for major repairs.

Most likely, you pay many of these fees as a homeowner, like insurance premiums or water bills. But you probably haven’t considered how having tenants affects water use, general liability, and multiplies the need for appliance repairs and routine cleaning.

The calculators’ line-items provide a sense of the distributed tasks of marketing, management, and administration;each section outlines your responsibilities as a landlord. Although these overhead tasks and costs seem like ‘little things,’ it is best to plan and budget for these elements so you’re not surprised by $15,000-$20,000 of annual overhead, split between saving for future building repairs and the annual costs of insurance, routine maintenance, and utilities.

‘Break-even’ Summary & financial resources

The final section holds the summary calculations and resources for navigating building financing and management.

8 Break-Even: This calculator pulls together the prior sections - your estimated income, appreciation benefits, loan and overhead costs - in order to estimate the annual net-increase in your building’s value.

Resources and Guidance: The final sections link outward - to Neighborhood Housing Services, Community Investment Corporation, and others - so you can work with their financing and management experts as you start planning a basement conversion.

how to think like a responsible landlord

If you’re converting a single-family home into two units, you need to shift your planning perspective. You need to approach a basement conversion as a landlord or owner-occupant. This means skillfully operating within both the demands of the marketplace and the laws that regulate the rental industry; competing for suitable tenants and, at the same time, complying with fair housing laws and municipal code. To successfully operate as a responsible landlord, you must plan for day-to-day operations and overhead as much as how and where to finance your basement conversion and what improvements you need to make.

Long-term equity vs. income

As you will notice from the Two-Flat estimate, converting a basement unit builds long-term equity in your property, slowly paying down debts and liabilities as your asset (the building) appreciates in value. Rent is not ‘extra’ income, but rather should respond to affordable area prices, your payment needs, and a desire to maintain long-term tenants. Depending on your existing mortgage debts and local prices, annual rental income and costs may not balance out for multiple years. As seen in the Two-Flat estimate, it could take a decade (minimum) for you to break-even on your initial investment. If you’re seeking to speculate on real-estate and anticipate resale in seven years, a basement addition is only likely to recuperate value that quickly in a best-case scenario. Typical drainage, foundation, and infrastructural adjustments are a sizable investment, which require a long-term commitment.

Consider the following:

Your Assets:

Are you in a position to take on those long-term financial risks (and rewards) given other debt and savings?Your Timeline:

Are you committed to spending another decade (or more) in your property (and community), as your building accrues equity?Your Priorities:

What are your overall financial goals for a basement conversion? Those priorities will be necessary to guide decisions—on designs, labor, rent, and maintenance—across the planning process and ongoing operations.

The content of the calculators—such as line-item costs for roof repairs or advertising units—should prompt you to consider the time commitments of serving as a landlord. As you ‘run the numbers,’ it is tempting to replace maintenance contracts with ‘sweat-equity,’ and overestimating your energy and expertise. To correct this tendency, test multiple budgets and review the linked property management planning tools at the end of the chapter.

Ask yourself: do the commitments, costs, and benefits of being a landlord balance out in your estimation?

Calculators

conversion scenarios & calculators

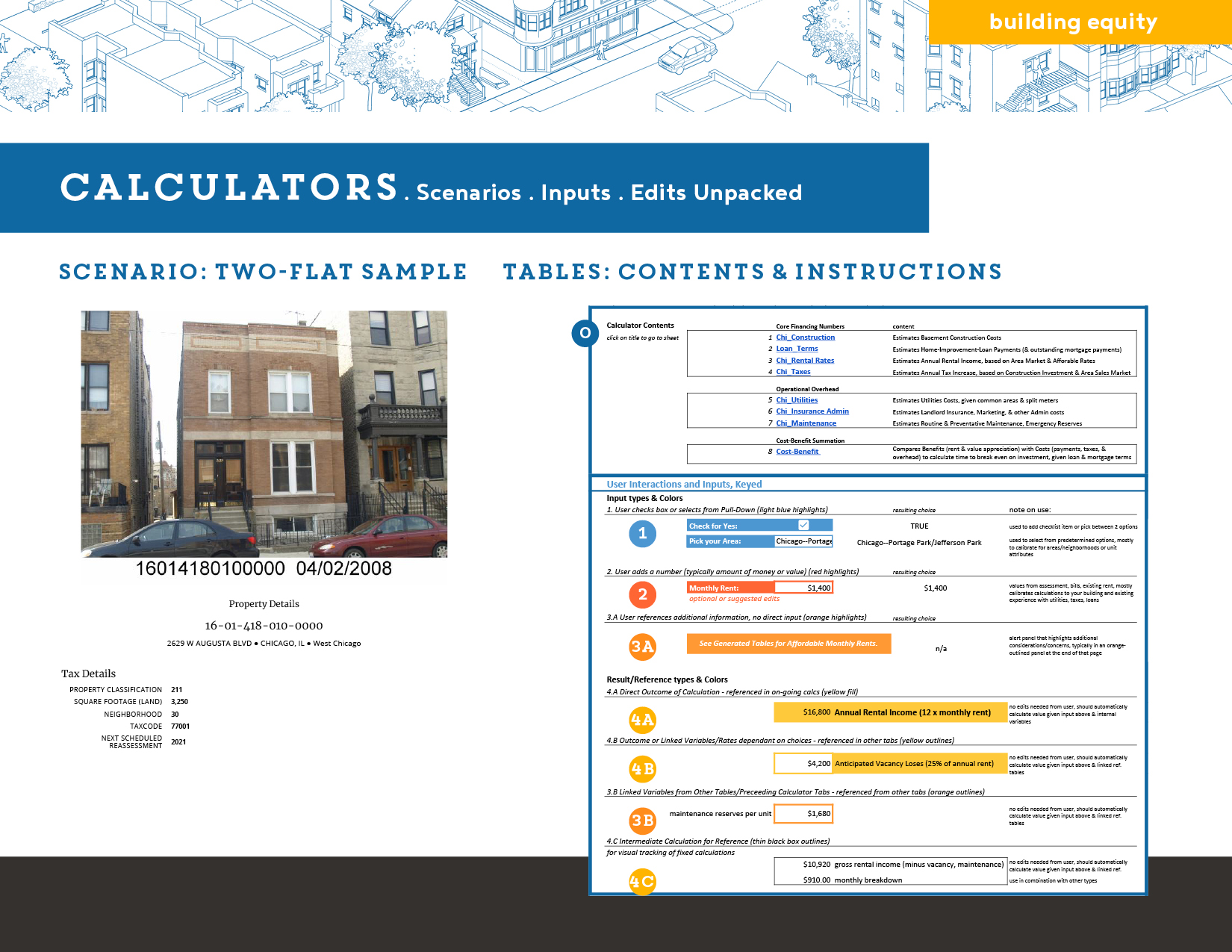

Just as it’s difficult to picture a desirable basement conversion without a few visual options, it can be difficult to understand the benefits and costs of property management in the abstract. To demystify those numbers and provide a ‘tour’ of the fiscal calculations of landlording, this chapter is built around a series of spreadsheet ‘calculators.’

These calculators are available in two forms:

- with a sample Two-Flat + Conversion project (view only)

- with blank or empty values for your edits and inputs (sign in to google drive to edit/download copies)

two-flat sample

The Two-Flat sample is meant to show a reasonable (to best-case) scenario for basement conversion. As a demonstration, it’s useful to note that the sample building is a brick Two-Flat, located at 2629 W. Augusta, just east of Humboldt Park, at the edge of Ukrainian Village (randomly selected, not NHS-affiliated). This area has a relatively ‘hot’ real estate market, so the building can support market-rate rents and appreciates value quickly. These factors play a large part in allowing the owners to break-even on their investment in under a decade. In addition, the sample Two-Flat is the type of small multi-unit building that could easily accommodate a basement unit. Because of its solid brick construction and separated utility connections, conversion is likely to be less extensive and expensive than for a single family Cottage. Together, the factors of location, condition, and adaptation costs strongly influence the overall balance-sheet.

As a completed sample, the Two-Flat scenario enables you to trace a series of decisions from page to page, following the logic and elements required for operating as a landlord. As you fill in your own calculations, referencing the scenario should help you to pin-point a) which variables strongly determine the financial viability of your project and b) how much control you exercise over those variables.

working in the calculators

The mostly-empty copy of the calculators is designed for you to add your information, listed next page, to produce a very quick estimate of project viability. Once you’ve set area and neighborhood variables - on the rent and tax assessment pages - you are encouraged to download copies of both the Two-Flat and Empty table as excel files. As you develop different scenarios, you can save copies and test alternate variables for alternate outcomes. These estimates provide a starting point for discussion with financial counselors and potential designers.

0 To make the estimation process as accessible as possible, the calculators’ prompts and questions have been color-coded, here and in the spreadsheets, to guide your inputs. (An introductory page, at left, and table headers on the calculators themselves repeat these instructions for ease of access.) Numbers (1-4C here) restart on each calculator, but colors are consistent across all sections. The inputs are as follows:

- 1 Light-Blue dropdown bars and check-boxes: These elements have preset answers (yes/no or a given list) and are typically used to pull reference information from hidden or collapsed tables. For instance, selecting your zip code loads information from a table of rental rates for your area from HUD.

- 2 Red boxes for adding numbers: These elements are set to zero and take a numerical input. Most of these boxes either reference your specific info—your tax bills, your water usage—or provide an option for you to customize values, like your unit rent, after reviewing market rates for your area.

- 3+ Orange Highlight Alerts: These elements don’t require an input but redirect your attention to supplemental considerations, so that you can customize red box values.

- 4+ Yellow boxes and bars / plain black boxes: These elements are the outcomes of embedded calculation and those in yellow link to either composite results or to the cost-benefit table. Do not edit either type as this will break the internal formulas.

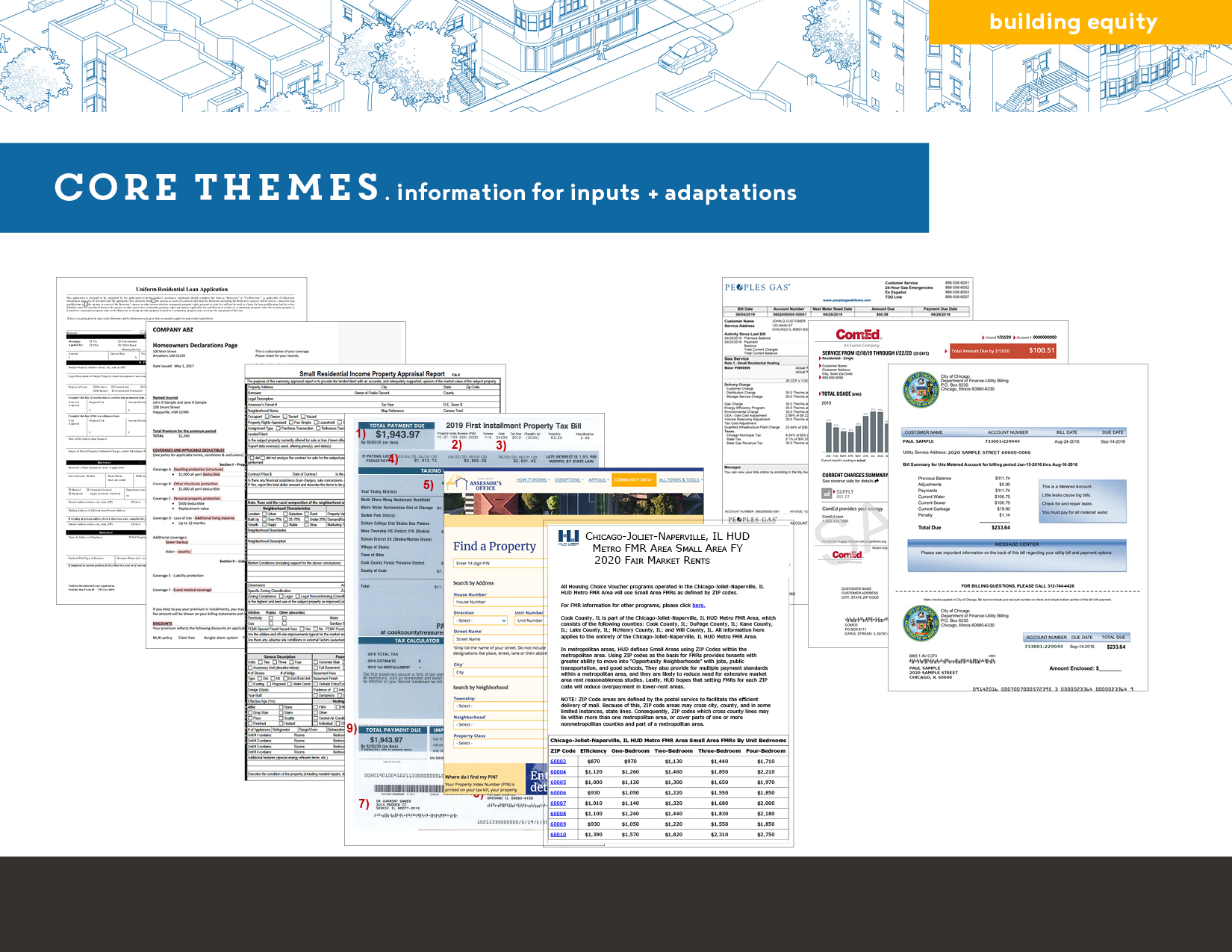

Core resources and references

Themes and Calculator Details

Many of the calculators can be run with generic values—Chicago averages or copies of the Two-Flat scenario data, but adding your own information will produce a better estimate. As you read through the thematic descriptions, you should gather the 'reference information,' as listed by topic, to fill in your own calculator estimate. Red values list formal documents for proceeding with planning and financial guidance. In general, the list suggests preliminary information only; there are multiple additional facets to considering property investment and management. The following are merely a concrete place to begin.

The information should be added to the calculators in sequential order to allow each estimate to build upon earlier information. All seven calculators must be complete—with generic data or your data—to enable ‘Cost-Benefit’ to accurately calculate.

capital investments

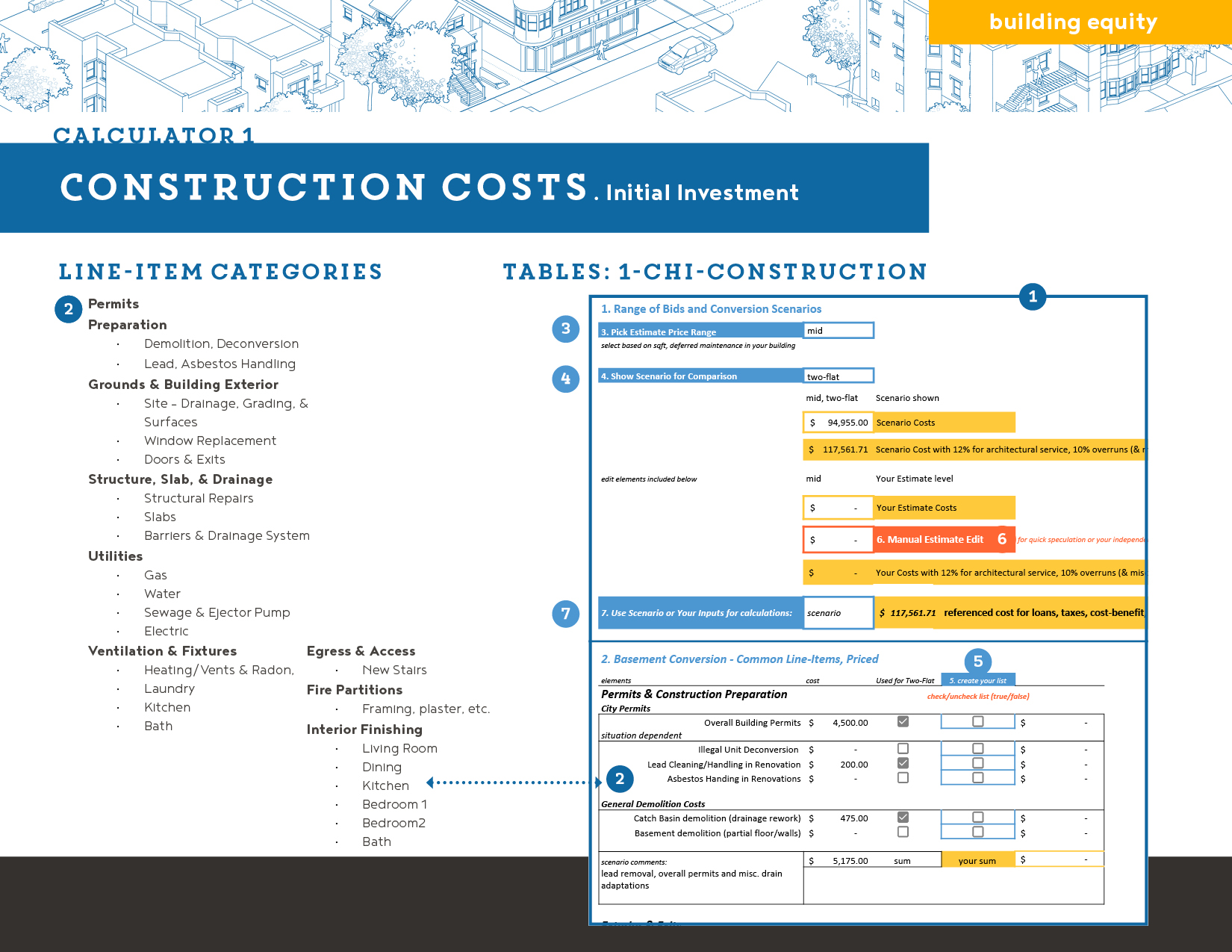

1 Construction:

The most obvious cost of a basement conversion project is the cost involved in design, permitting, and construction itself. The initial calculator ‘Chi_Construction’ provides a rough estimate of these costs, in advance of designing your basement project or getting professional bids.The estimate here feeds into loan calculations, revised home value, and the overall cost-benefit calculation.

- a general idea of main construction elements required for your basement conversion

- this list should be refined as you go through the mitigation chapter

- preliminary architectural plans and specs, for evaluation by an appraiser

reference information

Estimating project costs:

construction estimates

If you’re in the process of designing and planning a unit already, your architect should be able to give you far more specific estimates. They will calibrate costs to your design based on the specific alterations, the square and linear footage of work and materials, anticipated labor/material bids from contractors, and installation practices. Professional plans and construction estimates will be necessary for official appraisal of renovation value, loan applications, revised insurance quotes, and potential tax appeals.

For those wishing to develop a quick and dirty estimate, ‘Chi_Construction’ includes two parts:

- 1 Bid range and comparable construction scenarios, in the upper section, are meant to allow you to explore the line-item information through a more orderly and less overwhelming interface. Those drop-down options should allow you to switch back and forth between ranges/scenarios as you select line-items (below).

- 2 The construction line-item prices, in the lower table, are from a series of 2018 bids on basement projects, by Neighborhood Housing Services. The final calculations —of architectural overhead and 10% over-run margins— also include a percentage addition to cover inflation from 2018-2020.

3 As you explore construction costs and select elements that need altered (in the line-items), keep in mind what lies behind the upper options of high, mid, and low bids. Some of those price differences represent profit, but the greater portion represents the skilled labor required for construction, the quality of materials used, and the time that is required to complete a job safely and with care. It can be tempting to use low bids. For basements—where a rushed job could lead to leaks, mold, and the need for additional renovation—you don’t want to skimp on labor, time or materials. Start your estimates in the ‘mid’ range to be realistic and, after running all the calculations, test ‘high’ and ‘low’ options to understand their impact.

4 Based on your upper scenario selection, at the bottom-center you will see the construction costs of either a typical Cottage conversion or a Two-Flat addition, as illustrated in the ‘Common Conversions’ chapter. These scenarios offer a quick reading of the likely level of investment for common buildings and provide an approximate starting point for crafting your own estimate from the list of potential construction items. The list of potential elements and costs is broken down following the same categories introduced in the ‘Code Compliant Units’ chapter. The scenario’s checked line-items are summed within each category and the final composite estimate, at the bottom of the page, is shown in ‘Scenario Costs’ at the top.

5 On the right side of the line-item list are empty check boxes for your estimate: check those items you anticipate needing based on the ‘Code Compliant Units’ and ‘Mitigating Issues’ chapters. When in doubt, reference the scenarios for comparison. For those items you check, prices shown at the far right and are summed by category. As in the scenarios, the final summary of costs is then linked to ‘Your Estimated Costs’ at the top of the page. 6 Just beneath that box is an input where you can add either an independent estimate or test rough numbers as you explore the cost-benefit outcomes. An additional line calculates inflation, architectural overhead (12%), and over-run margins (10%) for the checklist (or your ‘test’ amount). 7 Finally you can toggle to determine which option should be referenced by the other calculators/tables.

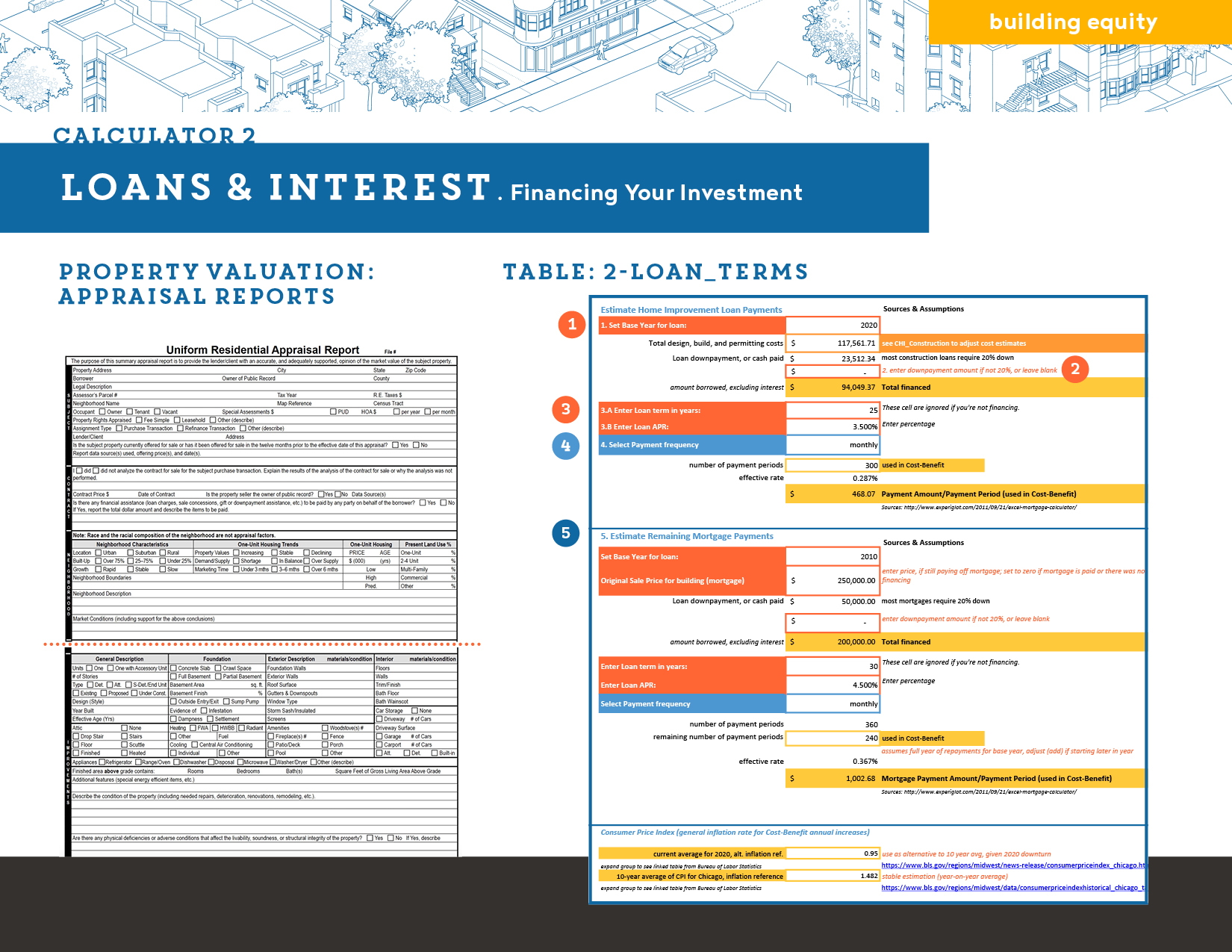

2 Home Improvement Loans:

Once you know the rough cost of construction, the next task is to consider how to pay for the project - from savings or with a loan. The calculator ‘Loan_Terms’ provides a quick calculation of payments for a home improvement loan along with optional, existing mortgage payments.

- basic background for your existing mortgage

- anticipated loan terms

- your credit rating, assets and debts, income-debt ratio

- loan quotes

reference information

Financing basement work:

Loan terms, payments, & prep

The calculator ‘Loan_Terms’ takes into account the amount borrowed (financed), rate it was lent at (APR), and the length of these loans. This snapshot—of annual debt payments and equity gain—should help you determine whether a conversion makes sense with your resources and investment strategy.

Broadly speaking, if you have good credit and a steady income you should be able to qualify for a fixed-rate home improvement loan. Talk with an accountant confirm the general financial feasibility tabulated here. In general, you’ll need to provide paperwork for a loan, documenting your:

- Existing Assets and Debts, including current equity in your building (the portion paid off) and outstanding mortgage debt.

- Credit Score and Annual Income, so that lenders can get an idea of your overall debt-to-income ratio

For new construction and additions, it is common practice to have an appraiser estimate the likely value of your planned project. As shown in the Appraisal Report at right (for Two to Four-Flat buildings), an appraiser will evaluate your project based on:

- the specific construction characteristics and finishes, with depreciation factors for the age and condition of the structure (middle & bottom)

- an analysis of the capitalization rate of the building, if it were solely used as an income property, and

- a market study of similar properties sold within a 1 mile radius of your building in the last 6 months (not shown), in order to understand your revised property value.

This helps establish the likely return on any money invested and thus the financial risk of the project.

If you have project plans and estimates from your architect and/or general contractor, you should be able to get an initial appraisal based on those specifications, for incorporation with loan applications. Talk with the loan originators at Neighborhood Housing Services to learn more about your renovation financing options. Talk with your accountant about the financial risks (and equity) of your existing assets and potential basement conversion project.

calculator contents

In advance of an appraisal and focused financial guidance, use the ‘Loan Terms’ calculator to estimate payment amounts and your overall annual costs for financing construction. This calculator loads the prior pages’ construction cost estimate.

1 To begin, set the current year, which will feed into new vs. existing mortgage payment calculations.

2 If you’re paying for construction with savings (not financing), set your downpayment to the full amount of construction; this will zero out payments and capture your lack of project debt. Otherwise, if you’re borrowing money, set the loan terms to match your loan (3: years, APR).

4 Toggle payment frequency to match your repayment schedule and this will calculate your required repayments.

5 Repeat the process for any outstanding mortgage on your property. Both the loan payments and mortgage payments (with timing variables and total loan amounts) are incorporated in the ‘Cost-Benefit’ analysis in order to estimate your total annual debt-payments.

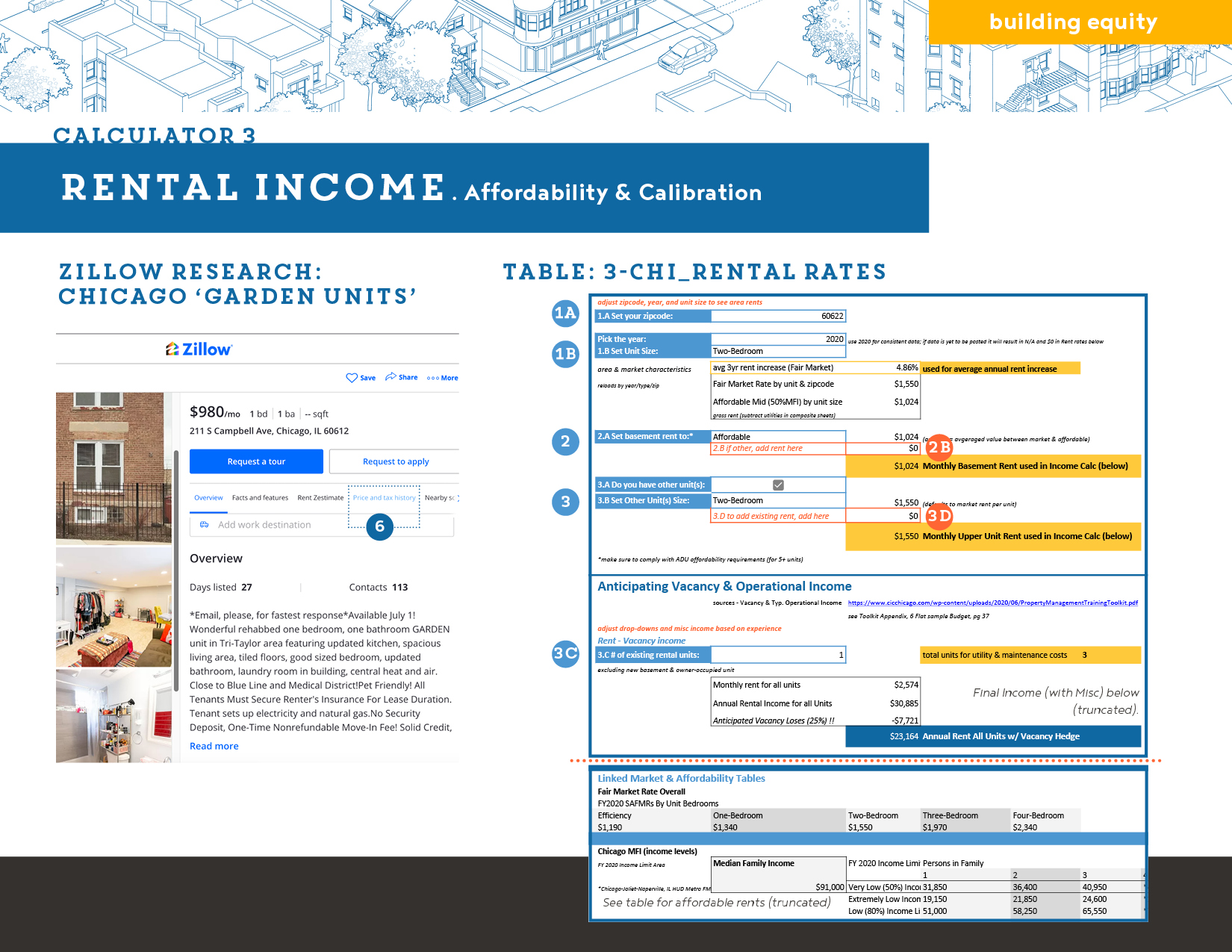

3 Rental Rates:

Setting the rent on your basement unit requires research into your local market and consideration of the relationship you wish to cultivate with tenants. The calculator ‘Chi_Rental Rates’ helps you explore rental rates in your area and calibrate rental income to building amenities and units.

- your zip code, to search HUD fair-market rates and Chicago's affordable rental rates, to guide your estimate of unit rent

- existing rents, if you have other units

- comparative research on rental units in your area

reference information

Establishing rental rates:

What’s affordable in Chicago

Setting the rent on your basement unit requires research into your local market and consideration of the relationship you wish to cultivate with tenants. You don’t want to have a vacant, overpriced apartment or a unit priced below its earning potential. Ideally, long term tenants who can afford their rent will be more pleasant co-habitants and reduce turn-over, vacancy, and extra legal and maintenance costs. As basement units are typically less desirable than elevated units, it’s particularly important to compare with other basement units in your area and price your unit affordably.

calculator contents

1 To start your income estimates, the ‘Chi_Rental Rates’ calculator begins by referencing HUD’s Fair Market Rental rates, an annual survey of average area rents, which is searchable by zip code and calibrated to unit size. It also pulls in HUD’s Median Family Income (FMI), which Chicago uses as the baseline for affordable units (60% FMI, with ~30% of monthly income as rent).

2 You then select which level —market, affordable, or averaged—makes sense for your basement unit and other rentals 3. This assumes basement units command less rent.

2b 3d Spaces are left so you can add your own rent values based on the local research, HUD estimates, or negotiated rent, with friends, family, or existing tenants you’d like to retain. To be conservative, the model includes 3 months vacancy (for move-out, cleaning, and marketing of units) as basements often experience higher turnover and lower desirability.

3c The lower half of the calculator then tallies these sources to establish building size and annual rental income. It also (not shown) adds miscellaneous income, like laundry change or parking rent, to estimate the final, overall income for your building. This preliminary annual estimate of rental income links to the ‘Cost-Benefit’ analysis.

other rent considerations

To finesse your estimate, you can conduct a (virtual) market survey of comparable units via Zillow, Domu, and Craigslist. If possible review the rents at a minimum of six to eight properties that are within your immediate market area (compare and contrast garden and upper units). Pick buildings and units that are of similar age and have comparable updates. As it allows for the search of active and past listings, Zillow may be the easiest way to see the history of past listings at a building and how long listings have been advertised. If an ad was up for months, the unit is likely overpriced. If a unit appears to have been rented within a month, then it’s probably priced well for the area.

You may want to visit those buildings that most closely resemble the apartments you are offering. Questions to ask:

- Do they have similar amenities, like laundry or outdoor space?

- Are they offering similar appliances/modern bathrooms?

- Are they on a busy boulevard or a quiet tree-lined street?

- Are they close to public transportation or do they offer parking?

- Is heat included or extra, electric (etc.)?

All of these differences will have an impact on the value of your particular apartment in its market.

The rent you should charge should be based on the strengths and weaknesses of your new unit and amenities—compared to similar properties—and finessed to build stable tenant relationships. Resist the temptation to raise rents during your initial estimates of project costs and benefits.

Note: If you are converting multiple basement units in a Five to Six-Flat Building (under the new ADU ordinance) at least one basement unit must be rented as an affordable unit for the first 30 years. Reference the City’s affordability tables to confirm affordable unit caps.

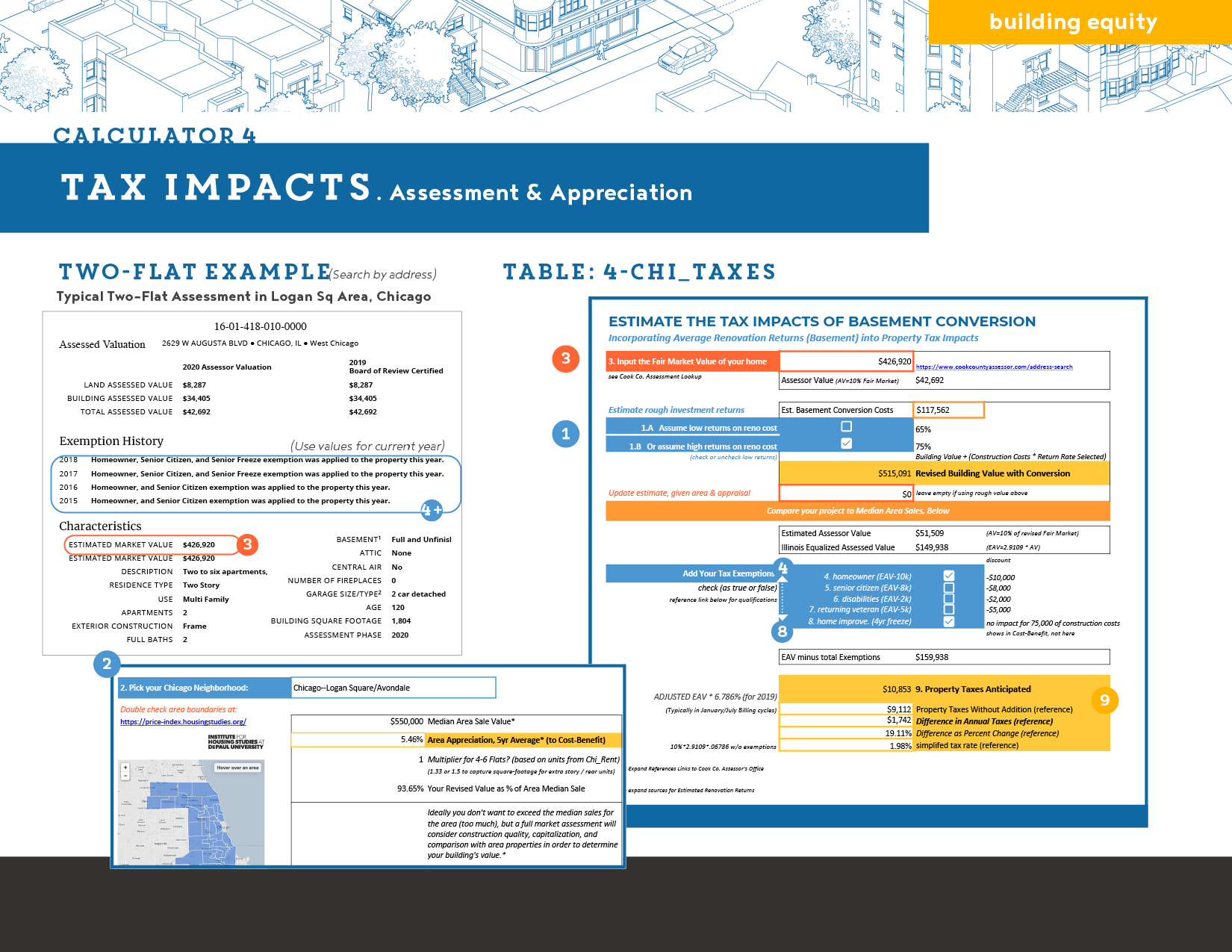

4 Taxes and Property Appreciation:

As you consider how home renovations add long-term value to your property, it’s important to capture how this translates into higher taxes. The calculator ‘Chi_Taxes’ determines likely tax increases for your property given area appreciation and your investment.

- Cook Co. Assessment of your property

- Identification of your neighborhood, according to census boundaries, as used in DePaul’s Cook Co. Housing Price Index

- anticipated building valuation by an appraiser

reference information

Calculating your taxes:

Property assessment decoded

Valuing your Basement Renovation, in advance of appraisal:

- 1 Renovation Value to be Assessed: This model starts with the estimated construction costs for an ADU addition (from ‘Chi_Construction’) and lets you pick high or low (75%, 60%) recuperation of construction as part of the property value.

- 2 Value Appreciation in relation to Neighborhood: This model references DePaul’s Housing Price Index, to estimate the 5yr appreciation average for areas across Chicago and track median sales prices. As the index tracks single family homes, this is a rough proxy based on relative square footage, meant to give an initial sense of whether your renovation is too expensive, i.e. far above the median. Appreciation rates link into the final cost-benefit analysis.

Once you have rough construction plans and costing, an appraiser can accurately estimate the addition of value and area appreciation. (See appraisal discussion in loan section.) The measures above are rough proxies; replace them with the appraiser’s estimate.

3 Assessment Values to calculate taxes and tax increase:

- Fair Market Value: The Cook County Assessor’s Office establishes the Fair Market Value of your unit based on building characteristics and neighborhood. Construction permits will trigger reassessment but you can also appeal for assessment. Look up your current valuation at https://www.cookcountyassessor.com/address-search.

- Equalized Assessment Value: This multiplier is meant to make property takes roughly equal across the state. For 2019, this is 2.9109 * Assessment Value (i.e. 10% of Fair Market Value).

Exemptions:

Exemption application and renewal procedures vary (some are automatic; others require forms), see linked Cook Co. pages. Checked exemptions are subtracted from Equalized Assessment Value in the current calculator:- 4 Homeowners (EAV-10k): Homeowners or owner-occupiers can deduct $10,000 from their Equalized Assessment Value.

- 5 Senior Credit (EAV-8k): Seniors qualify to deduct $8,000 from their Equalized Assessment Value (auto-renews) and can apply to permanently freeze their taxes.

- 6 Disability (EAV-2k): Persons with disabilities can apply to reduce their Equalized Assessment Value by $2,000.

- 7 Returning Veteran (EAV-5k): Returning Veterans can apply to reduce their Equalized Assessment Value by $5,000.

- 8 Home Improvement (4yr tax-freeze for >75k of improvement): This is triggered by construction permit applications and allows the deduction of the first $75,000 of improvements, with qualifiers. If checked, these rebates are applied to ‘Cost-Benefit’.

- See additional exemptions

9 tax rates

Cook Co. Tax Rate (6.786% for 2019): The Cook Co. rate for Chicago residents is calculated based on the city’s annual Corporate, Parks, Schools, Water District, and Forest Preserve budgets (plus other funds).

- The tax rate for 2019 was 6.786%, which is multiplied by your Equalized Assessed Value minus any Exemptions. The final outcome is your tax bill, as split into two annual payments. This annual tax value is linked into the ‘Cost-Benefit’ analysis, with increases tied to the consumer price index. Learn more about tax bills at the Cook Co. Treasurer’s pages. Over the last decade, the rate has fluctuated between 4-7% and may increase, given the city’s need for retirement funds. These tables assume a fixed rate for ease of calculation.

- Simplified Tax Rate: This composite rate is calculated without exemptions, for estimating tax on annual appreciation.

operating costs

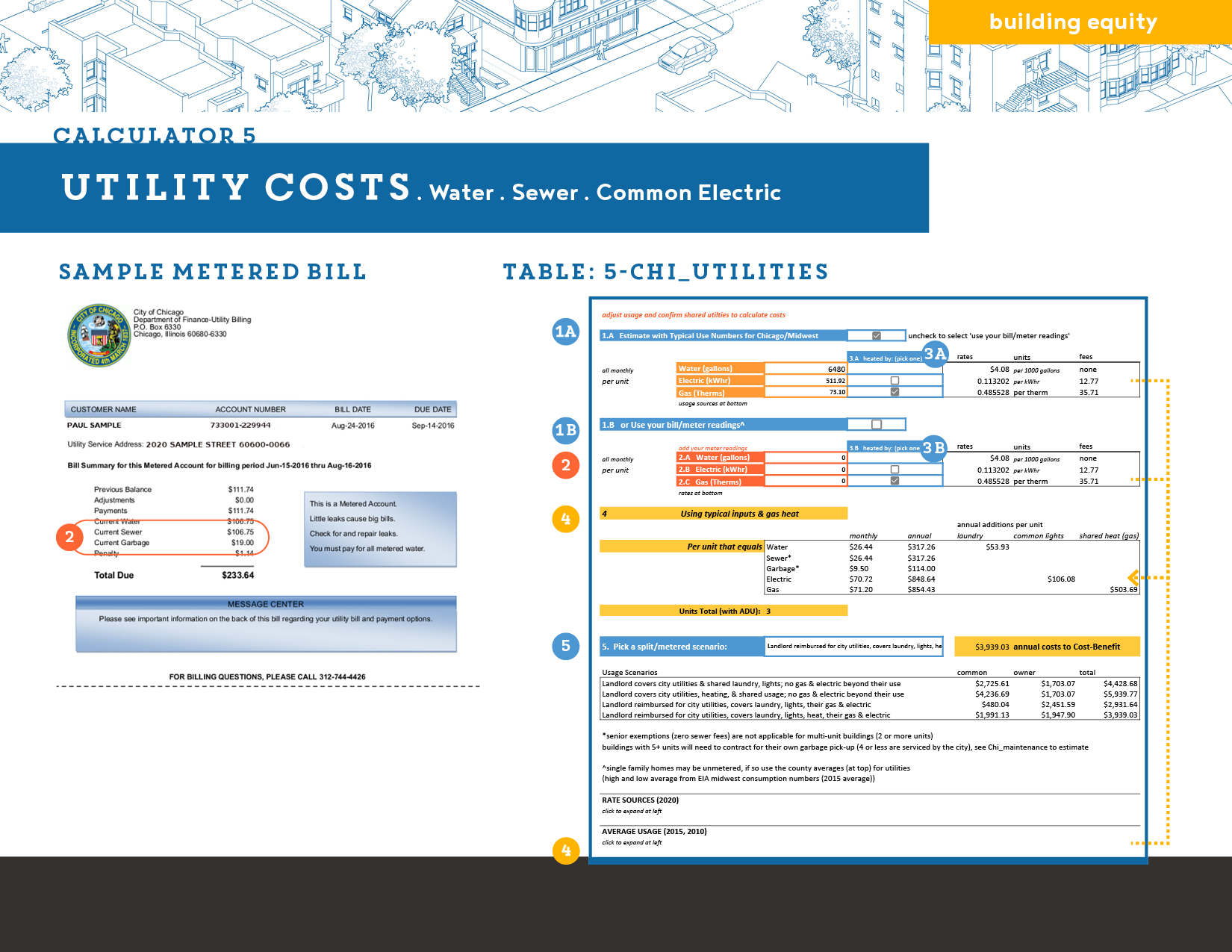

5 Utilities:

As you update your property, you will add multiple meters—water, gas, and electric—so disentangling utility and energy bills should be fairly easy. This calculator incorporates likely additional costs for common areas and overall usage, providing different scenarios for split utilities so you can estimate recurrent costs.

- your average meter readings from past bills (water, gas, electric, and any specific rates)

- an understanding of what resources would be shared in your building

reference information

Utility Costs

Water, sewer, garbage, power

In terms of additional costs for a multi-unit building, you should anticipate new charges to cover the common area electricity, additional water usage from shared laundry facilities, and, if heating from a steam system, increased gas bills for the finished basement. As the property owner, you will receive combined bills (shown at near right) from the City for each metered water line, which include sewage charges and garbage collection fees (for four-flats or less). As a multi-unit owner you are no longer eligible for sewer-rate reductions or cancellation. Your tenants’ gas and electric accounts should be entirely separate and billed directly in their name.

It is your decision as to whether and how to pass water, sewer, and garbage costs along to tenants, in pro-rated rent or variable monthly payments. Likewise, shared heating costs are commonly incorporated into overall rent calculations. If you have a larger building (Five or Six-Flat) and must rent one of your basement conversions as an affordable unit, you are required to calibrate combined rent and utility costs so that they fall beneath the city’s affordable thresholds.

calculator contents

The ‘Chi_Utilities’ calculator estimates annual, building-wide utility costs, to incorporate into your overhead calculations:

- 1 At the top you have the choice to estimate monthly costs based on a) averaged monthly volumes (water, electric, gas) for Cook Co. from the Energy Info Administration or 2 b) you can add your own meter readings, from a typical month for one unit. If using your past bills/meter readings, try to input an averaged value as heating and air-conditioning costs vary widely, given the Chicago climate. 3 For both average and custom values check to indicate whether using electric or gas for heating, as utilities charge lower rates for higher anticipated volumes. The rates shown for both options are taken from 2020 rates for City of Chicago, ComEd, and People’s Gas and are available at the bottom of the table.

- 4 The center section uses the selected monthly usage numbers (average or custom inputs) to calculate monthly and annual costs for one unit (the owner-occupied unit) and likely shared costs per unit. Laundry is typically 17% of a household’s water usage; common lighting is set to 12.5%; heating is assumed to be nearly 66% of gas usage. Your actual usage may vary but this provides a rough starting value to multiply by the total number of units in the building.

- 5 The bottom section offers four scenarios representing different levels of utility coverage by the landlord to be incorporated in the cost-benefit analysis. The most extensive and expensive is to absorb all city utility costs, shared heating, and common laundry/electric. The most minimal strategy is to pass city utility fees along to tenants and keep heating, gas, and electric all separate, covering only laundry and common lighting. Pick the scenario that most closely matches your anticipated separation of meters and building systems.

Broadly speaking, these calculations, over the long-term, are likely to slightly under-estimate the full annual cost of utilities. Gas and electric rates can be volatile as they are tied into energy costs and respond to climatic swings. In addition, the City of Chicago’s rates are tied into the cost of capital improvements. This calculator, which feeds into the ‘Cost-Benefit’ analysis, anticipates annual increases at the rate of inflation, which is low and steady compared to the factors above. See the City’s rates and billing page and your gas and electric provider to finesse these numbers with prior rates and personal usage.

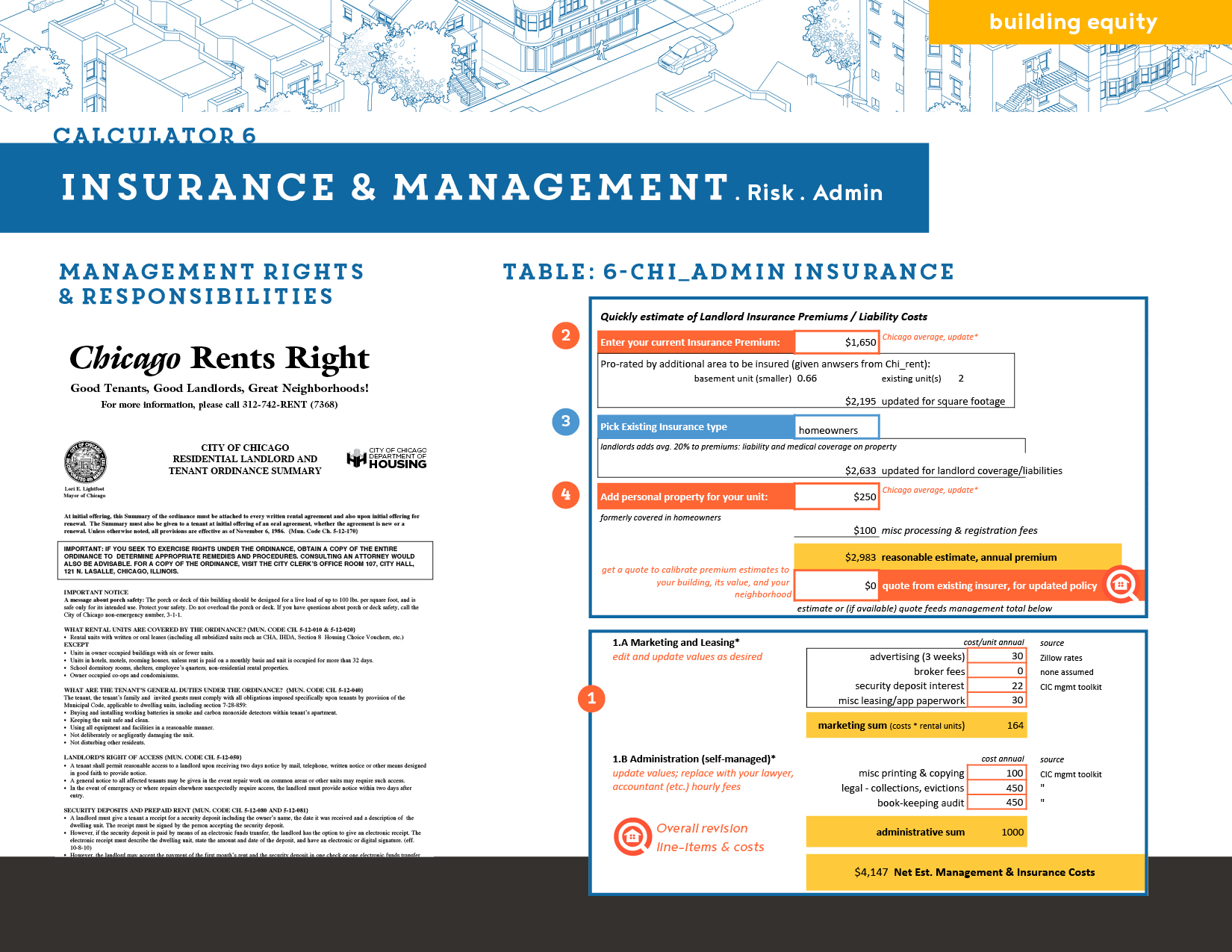

6 Insurance & Administration:

As a landlord, you have a number of responsibilities to tenants and greater liability for potential accidents in your building. This calculator estimates the management and insurance costs of running a multi-unit building. While relatively minor, these fees are necessary to find renters and avoid larger litigation costs in the wake of accidents and tenant disputes.

- your current insurance coverage

- a landlord policy quote for your revised building

reference information

Management Risks & Responsibilities

covering rental risks & administration

If you’re not a Two-Flat owner, the costs and task of management can feel nebulous. A quick way to get a sense of your responsibilities is to review Chicago’s Residential Landlord and Tenant Ordinance. As a small building (< six units), it’s not legally binding for your unit, but it offers a template for typical management tasks, including:

- placing security deposits into interest-earning saving accounts

- setting reasonable late payment fees (and legal caps of fees)

- setting rights of access and maintenance standards

- resolving tenant-landlord disputes and means of recourse

It’s advisable that you both read the ordinance summary and pass it along to tenants, so everyone is on the same page.

estimating administrative tasks

To flesh out a full plan and robust budget for managing your building, you should reference the Community Investment Corporation’s Property Management Manual. Their extensive guide covers marketing apartments, setting up tenant selection procedures, enforcement and eviction processes, and speaks to the relative cost-efficiencies of managing larger vs. smaller buildings.

Having spent time and money, creating a new unit and finding tenants, it is also essential to have the proper insurance to protect your basement investment. A landlord policy offers two broad types of coverage. It protects a) the physical structures on the property in case of a loss/damage and includes b) liability coverage, should a tenant/visitor slip and fall.

As you update to a landlord policy, it should have:

- Dwelling Coverage for the physical rental property: It is the cost to replace the existing structure.

- Other Structures for any other buildings like garages or sheds.

- Personal Property for your personal items: furniture, home goods, and computers. (Tenants will need renters insurance.)

- Loss of Use for any rental income you could lose. Set this to equal your annual gross rents.

- Medical Payments for any medical bills you may be responsible for.

- Liability Coverage for injury or lawsuits brought against the property (min. $500,000 coverage).

calculator contents

1 In terms of budget estimation, the ‘Chi_Admin Insurance’ table translates the bare minimum of tasks into low estimates, assuming you will manage the building yourself . What you see in the sheet, like the costs of marketing units on Zillow, or legal fees for a real estate lawyer, are meant as a best-case scenario facing evictions and rental turn-around. Consider, for instance, the ‘public’ face of showing units: do you need unit photos, cleaning, painting, or a paid broker to help show the apartment? That’s just part of the management cycle. Double-check and update costs as needed.

Landlord’s insurance is more expensive than homeowners and you can anticipate paying about 20% more a year for a landlord policy. For approximate numbers, input 2 your existing policy and 3 type . For quick estimate purposes, this calculates a landlord’s policy - with 4 personal property separated from building and liability costs - as 120% of homeowners rates, with rough increases for finished basement units.

For an accurate estimate, get an updated quote from your current insurer. Net costs from management and insurance feed into the ‘Cost-Benefit’ analysis.

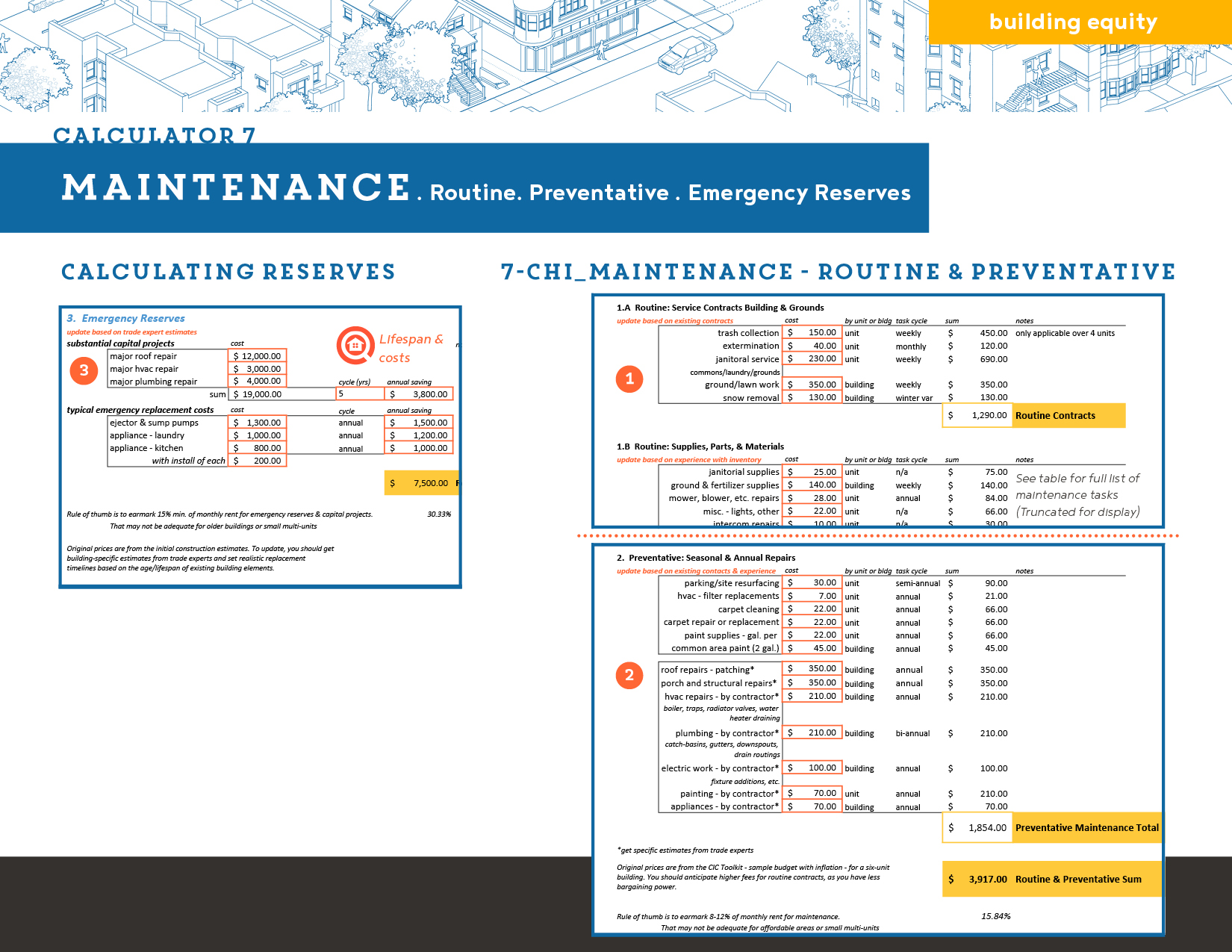

7 Maintenance:

For estimation purposes, the final section sorts maintenance into a series of routine tasks—occurring weekly, monthly, or on an annual preventative cycle—and a set of emergency reserve estimates to cover major repairs. The maintenance calculator helps you plan and schedule your maintenance in advance, to cover the cost of materials and synchronize seasonal tasks

- your current contracts for building and ground services (if applicable)

- estimates for capital and preventative repairs

reference information

Planning maintenance:

Costs, cycles, and reserves

If you’ve gotten this far in the manual, you’ve probably realized there is no such thing as a maintenance-free building. The purpose of maintenance is to keep the property safe, clean, and in good working condition. Regular repairs and annual assessments should halt decay and deterioration before it takes root - in common spaces, structural systems, mechanical systems, appliances and the building grounds.

As an owner-occupant, you may decide to do some of these services yourself, like lawn care or gutter cleaning. Even if you contribute labor, it is important to plan and schedule your maintenance in advance, to cover the cost of materials and synchronize seasonal tasks, like changing heater filters or checking radiator valves.

calculator contents

Conceptually, the main maintenance table includes:

- 1 Routine maintenance contracts & materials: Often accomplished by outside labor, these tasks correct problems that result from continuing wear on the property and equipment, accidents or abuse. This includes non-emergency repairs to the building, the equipment and the grounds such as performing snow removal, lawn care, sweeping, cleaning windows, and hallway vacuuming. Update by line-item.

- 2 Preventive Seasonal/Annual repairs & materials: This includes regularly scheduled upkeep on all areas of the property and equipment, esp. for heat/cooling. It allows trade experts to catch problems early and prevents expensive replacements to the building systems and structure. Update by line-item.

Your costs, for routine contracts and annual service, will likely vary from the generic rates above, which are derived from Community Investment Corporation’s manuals. As a small multi-unit building you are unlikely to have much bargaining power when hiring for lawn care or cleaning, and thus may pay more. For a more accurate estimate of routine maintenance costs, update the current line-items based on trade-experts connections and existing contracts. See Community Investment Corporation’s Property Management Manual and Training for more on developing a maintenance plan.

- 3 The final, reserve table outlines recommended savings for emergency repairs and capital building projects. While not as extensive as the routine list, you can anticipate that these funds will be used to cover long-term up-keep, like inevitable roof repair and furnace replacement. These funds should also be used to handle tenants’ (or your own) urgent or emergency maintenance requests, like replacing broken fridges or immediately fixing broken water pipes.

Your costs for emergency and capital repairs will likely vary from the rates listed, which are derived from the initial NHS construction cost estimates. You may want to add additional items to the emergency replacement list based on your building. For an accurate accounting of capital repair costs, get trade experts’ estimates of replacement cost and remaining lifespan (to time your incremental savings). All maintenance costs & reserve recommentations are summed and incorporated in the ‘Cost-Benefit’ analysis.

In addition to developing a maintenance budget and plan for yourself, it is helpful to remind tenants of their responsibilities to keep trash areas clean, notify you about extermination needs, and track concerns (moisture, slow drains, etc.) so you can address issues before they become expensive emergencies or code violations.

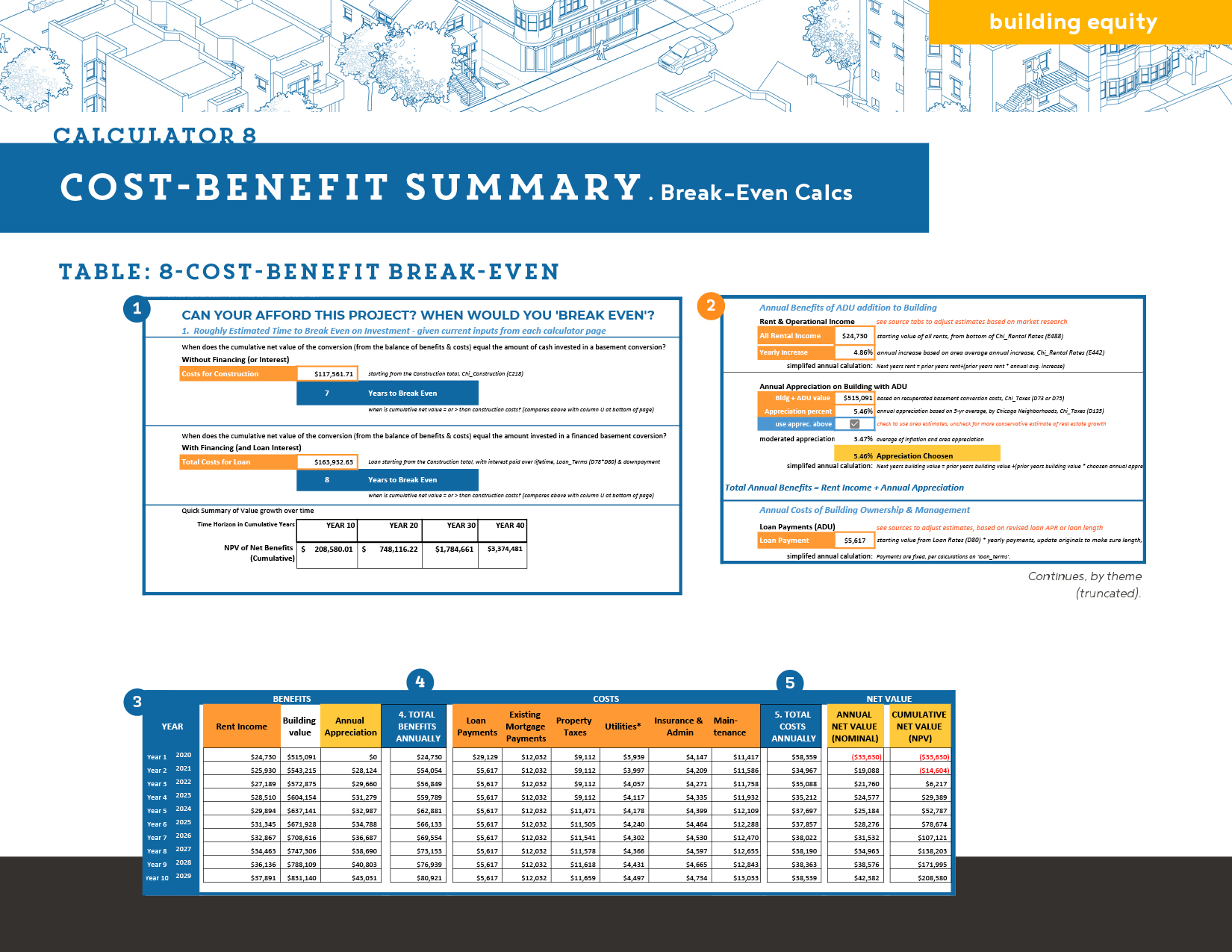

8 Cost-Benefit: (Break-Even Summary)

The final calculation table, ‘Cost-Benefit Break-Even’, takes the results of your prior estimations—of capital and operating costs—and sums them to determine your annual profit or debt and year-by-year cumulative net value.

- your investment priorities and a sense of when you’d like to break-even

reference information

break-even estimates:

Benefits, costs, & net values

The final calculation table, ‘Cost-Benefit Break-Even’, takes the results of your prior estimations—of capital and operating costs—and sums them to determine your annual profit or debt and year-by-year cumulative net value. For the most part this table compiles automatically. There aren’t many places to insert data or add custom values; rather, they should be adjusted in the prior seven thematic tables.

calculator contents

For ease of use, the layout is broken into three pieces:

- 1 The top section includes the key outcomes of your calculation, the break even values and a optimistic snapshot of decade-by-decade increases in value.

- 2 The middle explains where all the inputs are linked from, so you can flip back and forth between tabs as you seek to edit inputs.

- 3 The bottom sections hold all the annual cost-benefit summations, which track year-by-year profits and value accumulation.

At the top,1 the key outcome to examine is the break-even value. This tells you how many years it will take for the cumulative net value (of your building and rental income) to equal or exceed either the cost of construction (with or without financing), as derived from the bottom calculations. Consider your goals to contextualize this number: if you anticipate selling the building in five years it only makes sense to do a project that breaks even by year five. If you’re going to be there for the next 15 years, breaking even in 12 years is entirely reasonable. The ‘value growth over time’ provides a quick read out of longer term value accumulation. This over-estimates value, as appreciation rates are unlikely to stay stable over 40 years.

As described at the middle and shown at the bottom, the annual determination of nominal net value is calculated by adding your 4 annual benefits:

- rental income

- annual appreciation of building value

and subtracting your 5 total annual costs:

- home-improvement-loan payments

- mortgage payments

- property taxes

- utilities

- insurance & management costs, and

- maintenance costs. & reserve savings.

Year-to-Year calculation, for the next year’s benefit or cost in each column, is simply the prior year’s value increased by inflation. The exceptions are in appreciations, loan payments, and taxes. Appreciation is set to start once the renovation is complete, so it begins in the second year, based your neighborhood’s average five year appreciation rate. Loan payments start with both the down payment and monthly payments and then, from the second year on, only include the monthly payments. Taxes are frozen for the first four years (the home improvement exemption) and then are based on the appreciated building value. (This likely over-estimates your taxes, as the assessment cycle is much slower, but also serves as a useful hedge against unanticipated rate changes.)

In broad terms, the idea is to make sure that your gains in value (as liquid rent or fixed real-estate) are larger than your operating costs and loan liabilities, so that your annual (nominal) net value is positive. Once you’ve managed to eliminate your initial construction loan debt and balance your accumulate net value with your total construction costs (break-even), then annual net value additions are generating positive profit.

Finding Financing

NHS loan & project guidance

If you’re contemplating a basement conversion project and want to learn more about the construction process or home improvement financing options, make an appointment with Neighborhood Housing Services (NHS). NHS is a nonprofit neighborhood revitalization organization committed to helping homeowners and strengthening neighborhoods throughout Chicago and South Suburban Cook County. Neighborhood Lending Services (NLS), an NHS-affiliated corporation, is Illinois’s largest nonprofit lender for homeowners and new home buyers. Whether you are interested in free Home Buyer Education classes or a fixed-rate loan to buy a home or fix up your home, NHS has the expert help you need.

For those borrowing through NHS, they can assist with construction services, education, and loan origination. Taken together, NHS helps their clients to:

- Develop a detailed scope of work for your basement

- Assist in finding qualified contractors and procuring project estimates

- Answer questions throughout construction and inspects work for quality assurances

- Identify lead and material issues for mitigation, in collaboration with the Chicago Home Safety Partnership

- Provide energy, fire-safety, and code audits to help you reduce your building’s safety risks and environmental footprint

- Determine eligibility, terms, and rates for NLS’s non-profit loans, as well as forgivable loans and ADU/maintenance grants (as available) from the City of Chicago Dept. of Housing and Illinois.

Additional educational materials on energy efficient renovations and accessible additions can be found at Enterprise Community Partners (ECP, other funding below). Because Two to Four-Flat buildings are relatively small multi-unit buildings (compared to Chicago’s apartment towers), there aren’t major subsidies or special tax rebates directed at single building owner-occupants. For those investing at a larger scale, see Community Investment Corporation, next section, as well as ECP’s financing.

NHS courses & counseling:

- Financial Education: NHS’s financial workshops empower you, as a buyer or homeowner, to make smarter decisions and develop realistic budgets for your home investments. In response to the COVID-19 pandemic, a number of NHS classes are currently available on-line.

- Construction Services: If borrowing through NHS, construction services can help you navigate the entire home repair process, from finding contractors to making sure your home is safe, secure, and passes inspection.

- Loan Applications: NHS’s loan originators can help determine your financing options and whether your project is eligible for alternate funding sources. Talk with your accountant first to determine your existing resources and long-term goals.

Other funding / education resources:

- Multifamily Green Retrofit Toolkit, ECP: This toolkit includes sample projects, screening questionnaires, and other tools to help you assess whether your property is a good candidate for an energy-efficient retrofit, which could be productively combined with conversion work. In addition to construction, ECP also has educational materials aimed at developing sustainable property maintenance and management plans.

- Aging In Place Design Guidelines, ECP: Although not identical to ADA code requirements, ECP’s Aging In Place Design Guidelines offer an easy-to-understand approach to integrating accessibility into your potential basement unit.

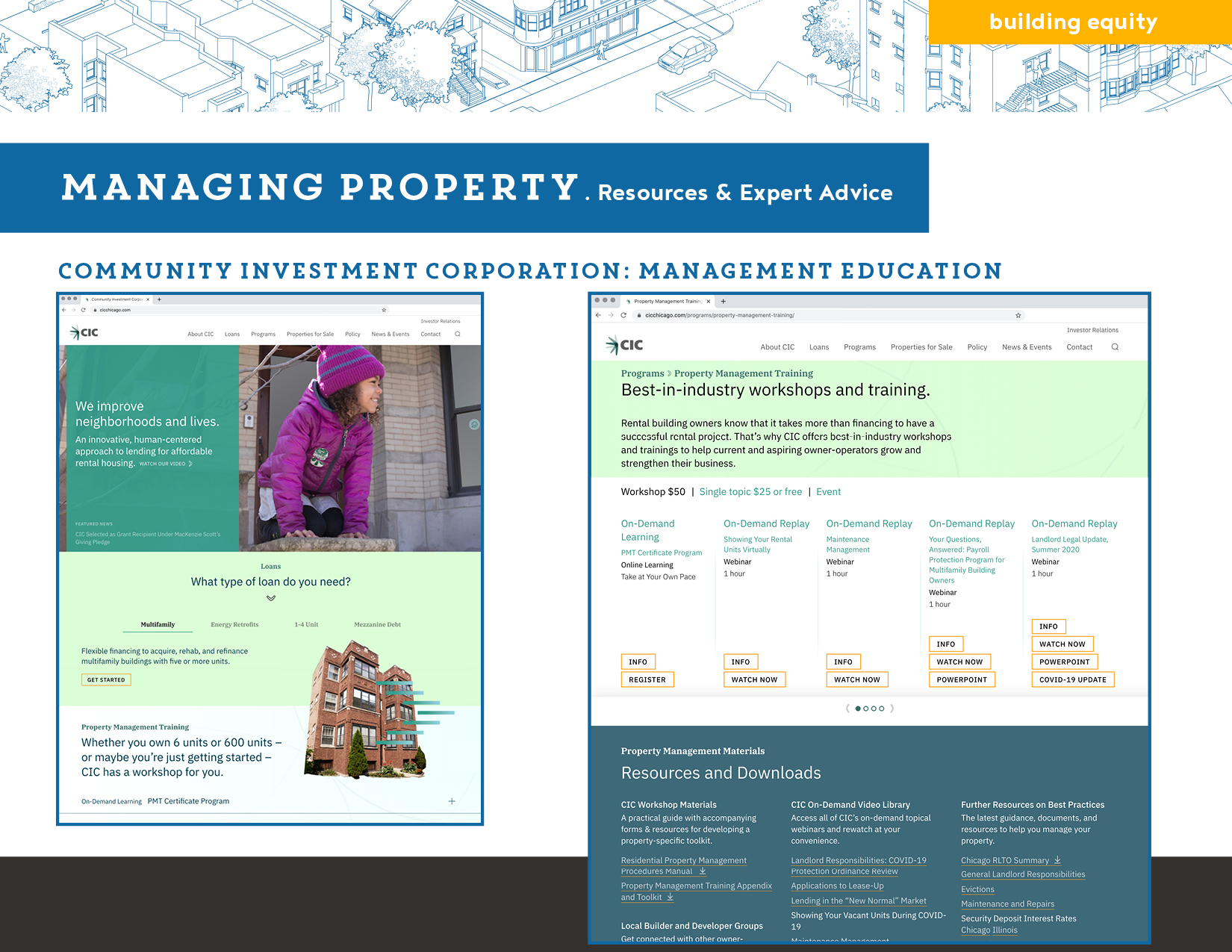

Managing Property

Management guidance: CIC

If you’re contemplating a basement conversion project and want to learn more about building management and maintenance, Community Investment Corporation (CIC) provides educational materials. CIC is the Chicago metropolitan area’s leading lender for the acquisition, rehabilitation, and preservation of affordable rental housing. CIC financing provides much-needed investment in credit-starved communities and ensures affordable housing for Chicago’s workforce. CIC’s Property Management Training Program provides owners and managers with the information and skills they need to successfully operate multifamily housing.

In particular, you can sign up for a property management training workshop, which:

- Prepares landlords with the knowledge to better market, manage and maintain residential rental property;

- Covers topics, such as marketing, fair housing, the landlord/tenant ordinance, insurance, nuisance abatement, real estate tax issues, maintenance and budgeting;

- Can be done online, through a series of thematic sessions; and

- Is accompanied by the Residential Property Management Procedures Manual and Appendix Toolkit, which includes sample budgets, legal and market resources for operating as a landlord in Chicago.

CIC also has a number of templates, forms, and booklets to streamline the process of maintenance/rehab construction and communicating with tenants. If you’re looking for specific area real estate and apartment associations, see their resources page. Additional educational materials on energy efficient maintenance and operations can be found at Enterprise Community Partners (ECP, links below). As a lender, CIC also finances affordable Two to Four-Flat housing at development scale, with loans for nine + building cluster investments.

CIC courses & counseling:

- CIC’s course and workshop schedule: for online and in-person courses.

- Residential Property Management Procedures Manual: A practical guide for developing a property-specific procedures manual.

- Property Management Training Appendix and Toolkit: Includes sample documents and forms useful for property management.

other management resources:

- Green Operations and Maintenance Tools, ECP: ECP’s green operations manuals provide templates and forms for a maintenance program and are designed to ensure that green design intentions are codified into operations and maintenance guidelines. Aimed at larger buildings, they are instructive to review for refining your maintenance plan.